It's Time for A Change

Since money is a taboo topic, many of us suffer in silence, but we don’t have to!

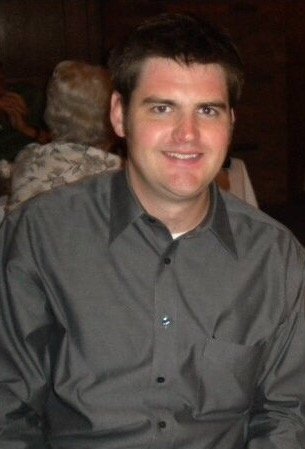

Working in the financial services industry for 15 years with global financial firms, I was frustrated that we often ignored the needs of everyday people because it was more profitable to serve wealthy clients. There’s nothing wrong with serving the wealthy, but helping wealthy people get wealthier is not what excites me. I get excited about helping everyday people build their confidence managing their money and building a solid financial foundation so they too can focus on building wealth!

After successfully paying off over $100K in student loans in 4 years and saving a year’s worth of expenses, I felt a relief that’s hard to describe. Ever since then, I’ve been focused on helping others achieve that same feeling. The sense of relief, accomplishment, control, and optimism.

One of the most effective ways to accomplish that is through financial coaching. I’ve found that people don’t just need information, they also need support and accountability in order to reach their financial goals.

Wilson Muscadin

Founder, The Money Speakeasy

Wilson is a financial coach, speaker, and Certified Financial Education Instructor.

He is passionate about empowering individuals to take ownership and control of their financial futures. He shares his personal experience of paying off over $100K in student loans in four years and professional experience coaching both individuals and couples by bringing more than just quality information, but tangible and practical tools to transform our relationship with money.

Financial Coaching May Be Right For You

Are you having a hard time:

- Creating a budget you can stick to?

- Prioritizing and paying off debt?

- Learning about and improving your credit?

- Building an emergency fund?

- Saving for a home/car?

- Understanding your employment benefits?

- Earning additional income?

- Developing a long-term financial plan?

If so, consider 1:1 financial coaching! Having a coach and accountability partner can be the difference between staying where you are or having breakthroughs and reaching your financial goals. Even elite professional athletes have coaches to help them improve and get better, why don’t you?

Financial Coaching Program Options

STARTER COACHING PACKAGE

1-month Coaching Program-

Discuss a single financial topic in depth

-

(1) 60-minute video conference call

-

30 days of coaching

-

Unlimited email support

-

-

-

-

-

PREMIUM COACHING PACKAGE

3-month Coaching Program-

Discuss multiple financial topics in depth and get a comprehensive plan to achieve financial success

-

(3) 60-minute video conference call

-

90 days of coaching

-

Unlimited email support

-

Personalized written financial plan

-

Access to my Become Your Own Chief freedom Officer(BYOCFO) online course (Value-$497)

-

Access to the BYOCFO private FB group

-

30-days money back guarantee

VIP COACHING PACKAGE

6-month Coaching Program-

Discuss multiple financial topics in depth and get a comprehensive plan to achieve financial success

-

(6) 60-minute video conference call

-

180 days coaching

-

Unlimited email support

-

Personalized written financial plan

-

Wealth building and financial security plan

-

Access to my Become Your Own Chief Freedom Officer(BYOCFO) online course (Value-$497)

-

Access to the BYOCFO private FB group

-

30-days money back guarantee

Become Your Own CFO Course

By the end of the program, you’ll be able to:

- Develop a wealth-building mindset

- Have a monthly written budget that you can stick to and be accountable to

- Set joint short, medium and long-term actionable financial goals

- Build and improve your credit

- Tackle your debt

- Understand your employment benefits

- Learn how to financially protect yourself and your assets

- Build a firm foundation for future wealth building

Imagine being able to make guilt-free purchases, finally being able to boost your savings account, and having the credit to purchase or refinance a home. You’ll feel stability, peace of mind, and pure satisfaction when you think about the path you’re on.